Fighting on three fronts could potentially be detrimental to Disney. On the western front, the studio is fighting both Hollywood’s directors’ union and the writers’ guild. The battleground is over residuals, AI, and writers’ rooms. On the eastern front, it is battling the Stamford, Connecticut-based Charter Communications. There, the fight is over retrans, cable fees, and cable’s role as a middleman.

But there is another front to be factored in. The southern battlefront that Disney opened with conservative Florida governor Ron DeSantis, who is currently running for the U.S. presidency. There, the issues are purely social and political, not industry-related, thus for the purpose of this review, we’ll keep that third front out of this report.

Even though the eastern and western fights are for separate and different issues, the goal is to develop a new (and winning) business model for streaming services.

Wall Street investors are watching each fight with interest, hoping to capitalize on every move, and indirectly determining where the resolution needle will settle. Meanwhile, investors are celebrating the strikes that have left the studios with millions in unspent money.

However, Disney’s timing for the fights is unfortunate because the long strikes have eroded consumers’ support and sympathy, which is something that Charter’s Spectrum is leveraging in order to resist Disney’s demands and introduce some of their own (as explained below).

Indeed, while years ago, pulling a channel out of a cable TV lineup as a negotiating tactic would have caused an uproar among cable subscribers, prompting cable operators to acquiesce to the programmers’ demands, today the protests are relatively muted.

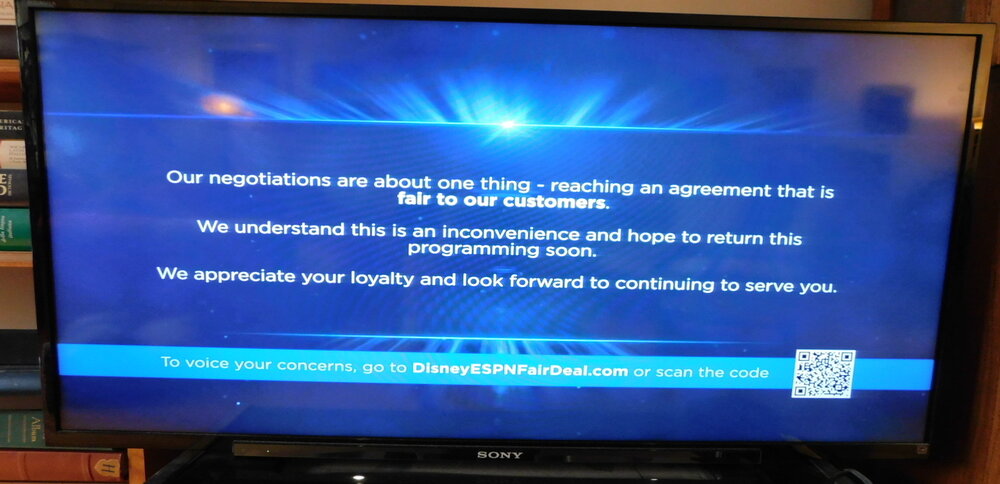

“The Walt Disney Company, the owner of this channel, has removed their programming from Spectrum,” is how a series of messages to cable subscribers began on August 31, 2023. Spectrum, which is owned by Charter Communications, carries Disney’s ABC-TV, ESPN, FX, Freeform, and National Geographic.

The dispute is not just over retrans and carriers’ fees. Spectrum is a major operator in several large cities, including New York and Los Angeles, and has 32 million subscribers in 41 states. It is the second-largest cable operator in the U.S. after Comcast.

“They also want to limit our ability to provide greater customer choice in programming packages forcing you to take and pay for channels you may not want,” is how the message from Spectrum continued on the TV screens.

Both retrans and cable carriers’ fees are necessary for the channel operators’ bottom lines, which are affected by reduced advertising and cable fee revenues due to cord-cutting.

The cord-cutting issue epitomizes the whole changing scenario, which did not start with the studios, but it was accelerated by the same studios that pulled the best programming out of their linear channels to make their direct-to-consumer streaming services (which are now outside cable’s control) more attractive. This action accelerated cord-cutting, which resulted in lower ad revenues (because of fewer viewers) and reduced revenue from retrans and cable fees (because of fewer subscribers). These actions pushed the programmers, such as Disney, to demand higher fees to compensate for the reduced revenue from cable. Cable operators (such as Spectrum) are not meeting the demand and are counterbalancing with their own demand to have cable offer the studios streaming ad-supported services. Thus, they are returning in a big way to restore their middleman status — something that the studios have, for years, plotted to eliminate.

Leave A Comment