In his latest book about advertising, Frenemies, American media critic Ken Auletta stated that “mass audience is rare.” This could well be the case in the U.S., but it is not true in Italy where Festival di Sanremo, a televised singing competition, garnered 11 million viewers with a 50.42 percent share, and the police series Inspector Montalbano also reached 11 million people, with a 42.45 share. In addition, a football (soccer) match between Juventus (Turin) and Madrid topped all with 13 million viewers and a 54.9 share. Over in Italy, linear TV is alive and well.

“Linear FTA is still very strong since the majority of the Italian population is reluctant to pay for TV content,” said Twentieth Century Fox TV’s Cristina Sala, who is based in Milan. “Despite this, pay-TV platforms, such as Sky Italia, still perform successfully,” she added.

Sala also said that “SVoD penetration in Italy is below the European average for a number of reasons, including the fact that fiber optics are mainly present in bigger cities and because Smart TVs have still not been broadly adopted by the Italian population. Additionally, the Italian birth rate has fallen to an all-time low. This has caused a lower demand for new technologies.”

Simone D’Amelio Bonelli, who’s content director for A+E Networks Italia, gave the point of view of a TV network, saying that, “the 25 million households served [by linear television] have a commercial value for the advertising sales market even if, in the last couple of years, it has become more difficult to reach significant audience shares in a very crowded marketplace.”

To Micheline Azoury of Rome-based producer and distributor of children’s TV fare Mondo TV Group, “Italian families are still traditional and they try to keep their kids watching linear TV — not through a tablet. [As such], the classic TV set at home is still doing well in Italy. And it’s not only in Italy, but in many other countries where the traditional way of watching TV for kids is still mainly through the traditional TV.”

Despite this line of thinking, Azoury also indicated that “the kids’ content offered on the Italian market is crowded and complicated at the same time.” The fact that “the country is also crowded with toys and licensing and merchandising related to IP in the form of animated series keeps linear TV offerings very competitive between various broadcasters,” she said.

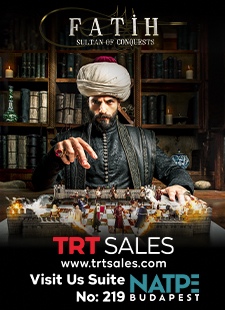

“There are important reasons for the success of linear television,” commented producer Agostino Saccá, a former president of RAI, Italy’s state broadcaster (pictured above with his son Giuseppe). “If we take the case of RAI, it is a family business for Italians and rooted in the imagination of the country. Their way of telling the story is very popular nationally and, especially at this time when anti-globalist drives are strong, it is a reference point for everyone, as confirmed by the large audience of the news, in particular of TG-1 [RAI’s main TV newscast].”

“Looking at the longevity of linear TV,” interjected Manuela Caputi, Mediaset’s head of International Sales, “we have to acknowledge that there are rituals that only linear TV can satisfy. For example, there’s the water cooler effect, which allows people to comment in a group setting, whereas OTT offers individualistic experiences. After all, humans are social people.

“This aspect of viewers’ behavior has not been lost on OTT operators, which now are focusing their marketing strategies to stimulate simultaneous viewing habits.

“Plus, linear TV remains the main content outlet due to high costs of production.

“The aging of the Italian population is also a factor in linear TV’s continued appeal, combined with the perception that linear TV is free, when we all know that viewers have to pay an annual license fee.

“Finally, there is an overwhelming number of OTT offerings, which tends to inhibit viewers’ ability to make a selection. OTT services are now developing ways to free viewers from this obstacle.”

But then, asked VideoAge: What is the potential of SVoD (vs. AVoD and TVoD) in Italy?

“Digital business in Europe has, of late, found subscription video-on-demand (SVoD) as the top choice of business models for OTT services,” explained Azoury. “SVoD is a great monetization model and is often the go-to model for any new OTT venture, as it ensures a steady, recurring revenue stream.

“The AVoD (advertising-supported video-on-demand) business was considered a less promising business model for OTT services. However, today, AVoD should be considered a complementary strategy to an SVoD or transaction-supported video-on-demand (TVoD) business model. We are working to grow our YouTube channel worldwide, but this is still a complex thing to do, and for now, it is mainly aimed at clearing piracy, which comes up often globally,” Azoury said.

To D’Amelio Bonelli, “SVoD and TVoD (as per Netflix and Amazon, but also Chili, locally) require high investments to keep the stakes high in the audience content agenda. On the other hand, AVoD needs to be supported by a clever advertising sales strategy. While linear pay-TV still has its appeal for news, sports, events and vertical propositions, FTA continues to deliver solid engagement. VoDs are interesting business models that should be considered in a wider frame.”

“SVoD has great potential everywhere in the world,” said Sala, “but Italy is just a bit behind other countries in adopting this new technology. With regards to AVoD,” she continued, “RAI Play is an excellent successful example of catch-up TV, even though Smart TVs are still not utilized by the entire population. Finally, TVoD platforms such as Chili Cinema offer very good services with potential for growth in future years.”

To Caputi, “the potential of various VoDs is shown by the fact that SVoD and TVoD are premium services that require some form of payment, while AVoD is for free, and thus is good for library content. Because the TVoD window precedes SVoD, the former could serve as teasers for both SVoD and AVoD.”

And what changes have there been in the last two years?

D’Amelio Bonelli explained that “the Italian TV market is a very mature one, and the content market has become various and competitive. We are entering a phase where content consumption would be a key driver of growth for a wider range of companies.”

“The main changes consist of the global offer thanks to companies such as Netflix and Amazon,” said Saccá, who produces films and TV series under his Rome-based Pepito Produzioni banner. “[These] have not yet affected the general viewers, but they are now deeply rooted in the elite public and young people. This has also pushed linear television to change. Think about RAI Play, which offers the same content as RAI linear television, but in a non-linear and very effective way.”

“The most visible change has been the exponential growth of free DTT channels,” said Sala. “The most recent has been Mediaset Channel 20 and the rebranding of Mediaset Focus. Viacom has led the path with the launch of Paramount in 2016 and Spike channels in 2017. Similarly, Cinesony and POP launched in 2017. The number of free DTT channels is around 50. Of those, around 35 channels air U.S., European, and Italian dramas. The two-year trend has seen a constant increase in free-TV advertising revenues. In fact, Italian free-TV advertising revenues, including Public TV license, amounted to 4.7 billion euro [U.S.$7 billion] in 2017, according to data from AGCOM, the Italian authority for telecommunications.”

At Mondo TV, Azoury said that in the last two years “we have noticed a huge change in production trends and acquisitions, with fast market growth for big players like Netflix and Amazon, and some new ways of watching television. This trend is increasing and will create space for new big players and for newly generated content. We are happy to be part of this huge trend, as Netflix announced their collaboration with Aurora World and Mondo TV to bring Yoohoo to the Rescue as an original Netflix series on their platform early next year.”

To Mediaset’s Caputi, the “big changes were prompted by the emerging large OTT players, which slowly but surely are changing not only the way we consume television, but also viewers’ tastes. One aspect of this is how TV viewers’ taste is migrating from watching films to preferring TV series, which are now attracting big stars and, in Italy, are spearheading the production of series based on theatrical movies.”

Audio Version (a DV Works service)

Leave A Comment