To explain the FAST phenomenon one could ask for comments from the top operators of these Free Ad-supported Streaming Television channels or just call upon the recently formed FAST Alliance. VideoAge did both. This follows VideoAge‘s first foray into the FAST ecosystem for its October 2020 Issue, when we featured an interview with Danny Fisher, CEO of FilmRise, one of the United States’ pioneers of FAST channels, which, although delivered via streaming, are different from SVoD and AVoD in the sense that they have a “linear” mode like broadcast TV (as opposed to an on-demand mode), and are thematic (focusing on such things as, for example, golf, food, soap, music, horror films, crime films, and game shows), like cable TV channels.

In this article we’re reviewing the key elements of FAST channels: content providers, platforms, programmatic advertising, playout providers, channel providers, and brand owners (a.k.a. publishers).

Let’s start with content. Jonathon Barbato, co-founder and co-CEO of the Los Angeles-based Best Ever Channel (BEC), a channel provider, explained that, these days content IP owners that want to enter the FAST universe have to start with a library of 300 hours minimum and update at a rate of at least 20 percent per month. But that is not all. “Three years ago,” said Barbato, “almost anyone with content could get launched. Now the platforms feel like they have enough channels, so getting launched is difficult, especially for those that don’t have channel ‘real estate.’ Platforms are now demanding an original, proprietary, and ongoing pipeline of content to differentiate a channel, and even to consider launching it,” he explained.

However, the troubles surrounding getting “carriage” (also called distribution) for a FAST channel is not all that different from the difficulties encountered by cable TV channels or syndicated programs.

To Christian Morsanutto of the Toronto, Canada-based Nextologies, a playout provider, “If distribution was king, now it’s emperor, and platforms are becoming more selective about the quality of the content.”

To alleviate the problem, distribution companies were developed, like the New York City-based TeleUp, a company formed by Gustavo Neiva de Medeiros to syndicate FAST channels to various platforms.

Currently, there are an estimated 1,500 FAST channels worldwide (75 percent of which are based in the U.S.) and 22 major platforms, including the connected TV manufacturers. Among the major ad-supported FAST platforms BEC’s Barbato listed are Roku, Samsung, Vizio, LG, Freevee/Amazon, Pluto, Tubi, XUMO, and Fubo.

Nextologies’ Morsanutto added, “FAST is still a predominantly North American event, but it’s now spreading around the world. Keep in mind that current linear channels are adding SCTE markers [cable and TV standards that are embedded within the video content, enabling coordination of advertising insertion] to become FAST channels.”

To Barbato, viewers’ current limit of FAST channels can reach a maximum of 200, however, he believes that “AI will make room for 1,000 channels because it will effectively only serve what an individual viewer wants.”

Platforms operate as aggregators and offer an ecosystem similar to cable TV operators. The revenue split between the platform and the channel is usually 50/50 on the net the channel receives from advertising, but some platforms ask for 60/40 in their favor, and others 45/55 in the channel’s favor. The platforms can also sell the advertising if the channel doesn’t sell its own.

Platforms are also gatekeepers when it comes to the selection of channels carried and for the way they’re delivered to them. According to Gustavo R. Aparicio, managing director of the Miami, Florida-based The Latin Beat, a FAST channels operator, instead of developing a unified technical standard, major platforms have allowed only four playout providers to deliver the playout stream: Amagi, WURL, Frequency, and OTTera.

Some publishers (FAST channel owners) also complain that there are cases when platforms create their own linear channels based on the successful results of other channels they carry.

In order to understand the role of a playout provider, it is important to describe the ecosystem of a FAST channel.

The creation of a FAST channel is a multi-task operation that involves the originator in the form of an IP owner (also called a publisher or a brand owner) who contracts a channel provider (like Barbato’s BEC), who in turn calls upon a playout provider (also called a video service provider, like Nextologies).

The IP owner comes up with the content. The playout provider is the tech company that actually creates the channel in the form of an interface using the “assets” (programming) to upload. The channel provider takes the interface and the assets from the playout provider and creates the lineups (which program the channel, also called the grid), plus it stores all the “assets.” These assets are then sent to the playout provider who delivers them to the list of platforms that the channel provider gives them.

As for the new uploads (new shows), the channel brand owner sends them to the playout provider, who stores the assets, which are uploaded by the channel provider as needed.

Another issue that channel brands are facing is the programmatic advertising process.

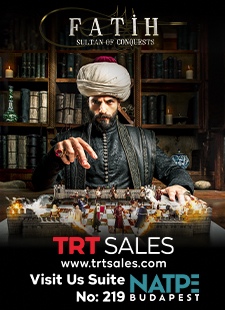

“The lack of transparency is a challenge, especially for publishers without direct ad server relationships,” said Gustavo Neiva de Medeiros, CEO of TeleUp, and president of the FAST Alliance (pictured on the front cover). He continued: “The key issue is distinguishing the average revenue received by publishers (channels) from what platforms or intermediaries receive. While a channel might average $7, the platform or intermediaries could earn $20. Addressing this disparity is a key area where the alliance aims to assist publishers.”

The whole FAST business is based on a revenue-share (rev-share) model wherein technical costs are charged by some playout providers (like Nextologies), while others (like Amagi and OTTera) have a hybrid model: part technical cost, part rev-share.

- The business model for playout providers is to charge channel providers per channel for storage, programming, seats, and platform delivery. So, if a channel provider delivers seven channels to seven platforms and are charged, for example, $1 per channel per platform the channel provider would be charged $49 per month.

The FAST Alliance has been operational since July 2023. “We represent FAST Channel publishers. However, we are considering the creation of vendor memberships with reduced voting power,” said Neiva de Medeiros. Its membership count is steadily increasing, with several applications pending board review. “We expect to have approximately 50 members by the end of this year,” added Neiva de Medeiros. Barbato’s BEC is a member of the FAST Alliance, as is Aparicio’s The Latin Beat.

FAST Alliance has a programmatic ad service, which is only available to members. “We have the best prices and the highest CPMs [cost per thousand viewers] and don’t carry a monthly fixed cost or ad manager fee besides the yearly membership dues for members who utilize the service,” explained Neiva de Medeiros.

Programmatic ad service is an automated method of buying and selling ad inventory in real time. It is basically an exchange using software and algorithms wherein publishers and advertisers combine to trade digital media.

Publishers make their ad inventories available through ad exchanges, while advertisers purchase them via real-time bidding (RTB). Thus, no humans are involved, and impressions are sold to the highest bidder.

Plus, these ad servers are responsible for storing ad content and delivering it to the channels. Ad servers also develop parameters (called “micros”). There are 10 key micros, like limiting the CPM at max $30. Between the ad exchange (ad server) and the publisher (FAST channel) there are two “middlemen,” or even three: The SSP, the DSP, and at times, the reseller.

SSPs, or Supply-Side Platforms, are used by publishers to sell ad space to advertisers across different exchanges. Also, ad agencies prefer to buy in bulk from platforms versus single channels.

By making their ad inventory available to large exchanges, an SSP helps to maximize the publisher’s ad revenue and their share is 10 percent of the revenues received from DSPs. According to content producer Matt Brummett from Overland Park, Kansas-based Space Mob, “Ad exchanges and SSPs are the same thing these days.”

DSPs, or Demand-Side Platforms, on the other hand, are used by advertisers to buy their ad space across many publishers’ websites. DSPs are also called “Seats” and they pay the SSPs, who, in turn, pay the publishers. DSPs allow buying ad impressions from ad exchanges for the cheapest prices. They usually take 10 percent of revenues received from ad agencies.

Resellers are entities that buy ad inventory in bulk and resell it to advertisers, often with added value like specific targeting or bundled inventory. If they are involved, a resellers’ cut is 20-30 percent of the revenue from the channel owner. Resellers are not well liked by some players, including OTTera, whose CEO, Stephen Hodge, compares them to people who, without a mandate, seek buyers for TV programs, and when found, go to the content owners to see if they want to make the sales in exchange for a commission.

According to the Middlesex, U.K.-based Digital TV Research, global Free Advertising Supported Television revenue is now an $8 billion industry in the U.S. Currently, the U.S. accounts for 56 percent of the total FAST business. Global FAST revenues are expected to increase by $9.4 billion between 2023 and 2029. This compares to $39 billion in global revenue for AVoD channels (the U.S. accounting for 40 percent) in 2023.

Another issue is that many IP owner are reluctant to sell their shows to FAST channels even on a 50/50 rev-share basis without a minimum guarantee (MG) because there is not a clear model to determine the ad-share going to the IP owner.

In most cases, the channel owner gets monthly reports. If the platform partner also sells advertising, its revenue reporting can be by title or by channel. If done by channel, the channel owner also needs a report from the playout partner in terms of a particular program’s hours of viewing (HOV). For example, if in a month a channel’s HOV was 1,000 hours and said program had 100 HOV (10 percent), its share of ad revenue is $50 in a 50/50 share if the channel received $1,000 for that month.

FAST channels are based on a long-tail model in which content in low demand can make up market share that rivals blockbusters, but only if the distribution channel is large enough. And this drives the quest for the channels to be on multiple platforms.

A good portion of AVoD and FAST content consists of existing film and TV library material, with a smaller portion of that coming from licensing deals on a rev-share basis, which only a few established distributors are willing to do, and only with the 10 major players, such as Pluto, Roku, Tubi, Vudu, or Freevee.

The new “viral” ecosystem that is now engulfing the international TV industry is also flooding the market with low-cost, low-quality content that is financed on a rev-share basis, with the talents absorbing most of the initial financial burden. Some of this new Social Media content that manages to move to OTT with broadcast-quality results is subsequently licensed worldwide by established international distributors. The New York City-based FilmRise, for example, licensed Preston & Brianna, a popular YouTube reality show.

Similarly, distributors with extensive film libraries, such as the Los Angeles-based Multicom, license content, in the words of Jesse Baritz, Multicom’s VP of Content Acquisition & Development, “to all different kinds of media, including for their own FAST channels.”

Some channels, like Vevo, don’t buy content, but receive music videos directly from labels and artists. Based in New York City, Vevo has a portfolio of 20 FAST channels in the U.S., Canada, the U.K., the E.U., Australia, and New Zealand.

According to Rob Christensen, evp, Global Sales, Vevo, the company “shoots and produces original content consisting of live performances with participating artists.”

The historical aspect of FAST is also not too clear. According to OTTera’s Hodge, in 2015, XUMO produced the first FAST channel, when XUMO was a joint venture between Viant Technology (part of Meredith Corporation) and Panasonic. Today, XUMO is jointly owned by Charter Communications and Comcast.

As for the FAST acronym, many credit it to the American media analyst Alan Wolk, who used it in a December 2018 article. However, Nextologies’ Morsanutto disputed the account, explaining that “FAST has been around for many years. The only difference is that back then, instead of SCTE markers, there were DTMF [automated control] tones.”

In our 2020 article, VideoAge reported that FAST was “originally created in Los Angeles in 2014 by Pluto TV, which was acquired by ViacomCBS in 2019. It has also been reported that in 2012, Joe Kovacs, president of the New York City-based Screen Media Ventures, was toying with free streaming services. However, he said, “We were thinking of a linear streaming service for our movie library, but we settled for an ad-supported VoD service that we simply called free VoD.”

(By Dom Serafini)

Audio Version (a DV Works service)

Leave A Comment