Recently, journalists, commentators, and pundits alike have been warning us not to trust predictions for 2024. Especially those that have anything to do with finances. They seem to agree with the expression that “Nobody knows anything!” This should probably also be taken into consideration at the major U.S. studios when executives come up with strategies regarding mergers and acquisitions.

The first salvo was fired in late December 2023 by The Wall Street Journal, when it explained how “Investors [in 2023] have been more influenced by perception than reality.” Other newspapers followed suit, detailing how forecasters were very wrong about 2023. At the end of 2022, U.S. financial analysts predicted that the S&P 500 (a stock market index tracking) would gain 6.2 percent in 2023. At the end of 2023, though, the gain was 25 percent.

Back in 2022, forecasters had predicted that the stock market would have increased by 3.9 percent. In actuality, it lost 19.4 percent.

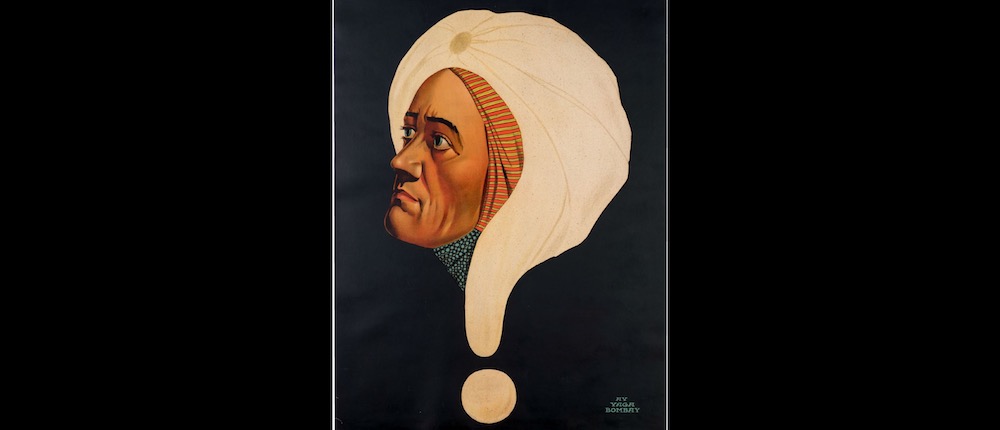

If the future is often predicted as problematic, the past tends to be remembered better that it actually was, even though the past is difficult to analyze. The proof for that is that companies, governments, and people tend to repeat the same mistakes over and over again. After all, as the saying goes “To understand the future look to the past.” Perhaps this is why phrases like “yestermorrow” were coined, as they emphasize the connection between past and future events.

Let’s now close this edition of the Water Cooler with some popular aphorisms: “It’s hard to make predictions, especially about the future” (from Danish humorist Robert Storm Petersen, 1882-1949), and “The best way to predict the future is to invent it” (from American computer scientist Alan Kay).

Leave A Comment