Canada’s TV Acquisitions Outside the U.S. Studio

In Canada, where the thirst for content is truly unquenchable, independent distributors play a key role. Take The Handmaid’s Tale, set to return for a second season in April. Here was a Hulu original shot in and around Toronto and based on a cherished novel by revered Canadian author Margaret Atwood. When the series was shopped around at MIPCOM in October of 2016, Chris Ottinger – president, Worldwide Television Sales and Acquisitions, MGM Studios – had no doubt he’d have strong interest from Canadian broadcasters. Surprisingly, however, a deal took several months to close. In the words of one Canadian network executive, “times have changed.” Network buyers must now face competition from counterparts both foreign and domestic, as well as from streaming services such as Amazon and Netflix.

Read the complete cover story in the January issue.

Netflix Offers Solutions to Traditional TV

It’s clear that Netflix represents a formidable problem for linear TV channels. However, it also offers a solution to those same channels with which it competes. Indeed, Netflix can be a path to a continuous and prosperous future for traditional TV networks. Last June, The New York Times‘ Sunday magazine ran a story about Netflix that basically replicated what VideoAge wrote in its January 2014 issue, noting that Netflix has cash flow problems, that it generates little profit, and that, in order to survive, it constantly has to generate new subscribers by entering multiple international markets.

Read the complete cover story in the March issue.

A Greek Tragedy in the Making For Europe’s AV

In 2015, the European Commission (EC) set in motion what film, TV producers, and broadcasters alike consider to be a serious erosion of their right to exploit content on a territory-by-territory basis in the European Union by mandating cross-border access to audiovisual (AV) content and services, known as the European Commission’s Digital Single Market strategy. In 2013, the European audiovisual industry generated revenues of approximately 83 billion euro (U.S. $103 billion), of which about half of that was spent on content. It has been common practice for content to be licensed exclusively by a territory or country because this typically yields the highest license fees and return on investment for producers (generally, a premium is paid for exclusive rights by a licensee, instead of a licensor having to line up multiple non-exclusive licenses).

Read the complete cover story in the April issue.

The Ups & Downs Of The LATAM Export TV Market

In 1986, the Latin American TV scene was starting to emerge as a force in the export market (so much that VideoAge launched a Spanish-language version, VideoEra). At the time it was the first such publication for the LATAM sector. VideoEra enjoyed but a brief shelf life because – even though the territory was awash with television-related activities – it had not yet reached the “critical mass” needed to support a trade publication. Add to that the fact that the content sellers, mostly Americans, were still struggling with collections in that vast territory, and were thus less inclined to promote their shows in LATAM.

Read the complete cover story in the May issue.

L.A. Screenings 2018: Same Drill, But Unchanged Enthusiasm

The L.A. Screenings in facts and figures: This 55th edition saw 84 companies exhibiting at the InterContinental hotel located in the Century City area of Los Angeles, and was comprised of a mix of indie companies and U.S. studios, representing 17 countries. New this year was a series of conferences organized by NATPE under the banner L.A. Screenings Independents and the requirement of a $50 market badge to access all the NATPE-sponsored activities, including the summit, networking breakfast, and the indie opening party. This fee was introduced for the first time this year, causing some confusion (since no fee has ever been required before).

Read the complete article in the June/July issue.

Facebook Created a “Dark” Social Media Precedent

Il Lato Oscuro di Facebook, which can be translated as Facebook’s Dark Side (Imprimatur Publishing Company, 126 pages, 14 euro), by Italian journalist Federico Mello, is a brief Italian-language treatise examining fundamental questions posed by Facebook, the undisputed world leader of the Social Media revolution. Is the satisfaction of receiving a notification on Social Media addictive? Are there ethical and sociological implications if a company profits from this addiction? And, going over to the “dark side” for a moment, what if a company collects your habits and preferences and compares them with others in order to keep you hooked on a process that generates revenue? These are just some o the many questions the book tries to answer.

Read the complete cover story in the September issue.

Wall Street’s Growth Over TV Profits

Fracking, the technique to extract oil and gas from rocks, has made the U.S. the world’s largest producer of natural gas, as well as an oil powerhouse that, according to The New York Times, is “ready to eclipse both Saudi Arabia and Russia.” Yet, wrote the Times, fracking’s biggest skeptics are on Wall Street. Why? Because the industry’s financial foundation is unstable. Fracking is not generating enough cash to cover expenses. The 60 biggest fracking firms had negative cash flows of $9 billion per quarter.

Read the complete cover story in the October issue.

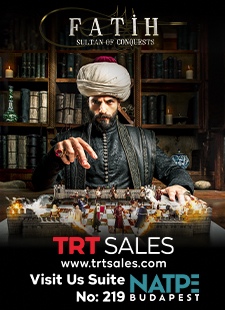

Turkish Dramas to Circle The Globe On a New Channel

The Timeless Drama Channel (TDC) is a new venture from multinational group SPI International, which is headquartered in New York City, and operates a total of 16 offices around the world, including Israel, Poland, Tokyo, and Mexico City. This December, TDC will begin broadcasting Turkish TV dramas worldwide, because, explained Berk Uziyel, the Istanbul-based managing director of SPI International, “Turkish television dramas are now watched by more than 400 million people in some 140 countries. He also pointed out that “Turkey is globally the second highest exporter of TV series internationally, after the U.S.”

Read the complete cover story in the November issue.

Hollywood’s Big Picture Expands Out of Its Frame

“I loved that job.” That’s what Amy Pascal told The New York Times in June 2017 about her stint as chairman of Sony’s Motion Pictures Group. “I loved it so much, to be honest, that I didn’t allow myself to believe that the movie business had moved on.” Hollywood’s ongoing development – its improvement or decline, depending on who you talk to – is the subject of Ben Fritz’s comprehensive book-length investigation, The Big Picture: The Fight for the Future of Movies (304 pgs., Houghton Mifflin Harcourt, 2018, U.S. $27). The first half of the book chronicles the rise of the franchise film era using Sony Pictures as a case study, and Pascal plays a central character.

Read the complete article in the December issue.

Leave A Comment